Manage your essentials, safeguard

your family, and save — all in one place!

Enjoy the perks of your membership with our handpicked selection of products tailored to enhance your everyday life.

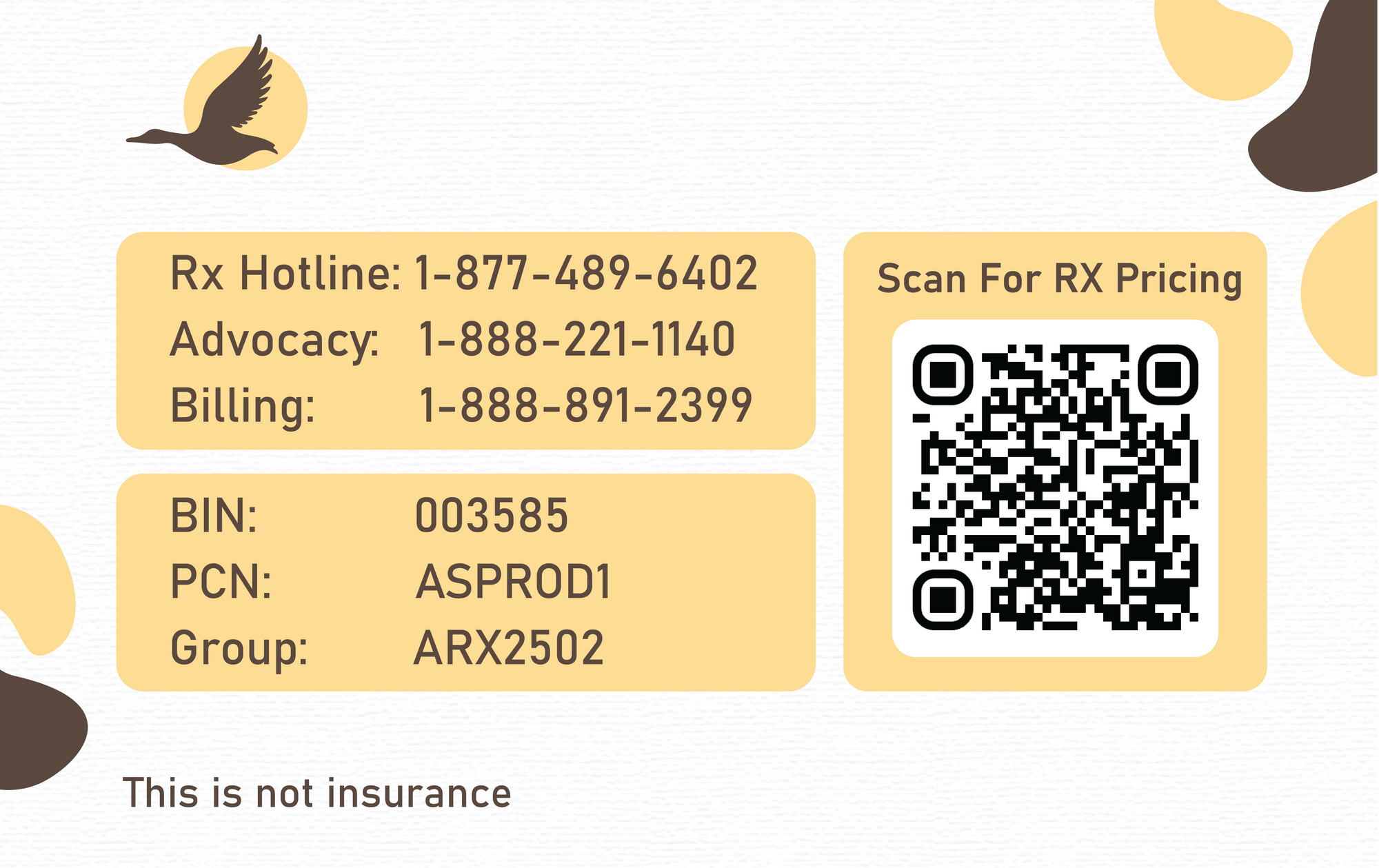

Access your healthcare essentials effortlessly with our digital membership card! From prescription codes for pharmacists to easy-to-reach advocacy and billing numbers, everything you need is at your fingertips!

How to save on RX?

Access health and wellness tools, expert tips, nutritious recipes, and insightful articles crafted to support your journey towards optimal health and vitality. Your journey to a healthier, happier you starts here!

Our tools and strategies aim to help you control your medical debt, and not fall victim to corporate greed, fraud, and harassment.

You Are Not Alone:

Understanding these codes is crucial for navigating your medical bills and ensuring you are not overcharged.

Nonprofit Hospitals and IRS Section 501R

Understanding Medical Billing Codes

Common Issues with Medical Billing

Taking Control:

Review the Bill:

Apply for Financial Assistance and Make a “Good Faith” Payment:

Identify instances where hospitals impeded cooperation or breached federal laws. Utilize these findings as leverage to negotiate reductions in your bills.